How to Use Forex Backtrack Simulator

Master Forex backtesting and refine your strategies using historical data with Forex Backtrack.

Get a Free TrialSetting Up MetaTrader 5 (MT5) Before Launching Forex Backtrack

Before launching Forex Backtrack, you need to configure some essential settings in MetaTrader 5 to ensure smooth functionality of the simulator.

Configuring MT5 Settings

- Open MetaTrader 5 (MT5) and navigate to the Tools menu.

- Select Options from the Tools menu to open the Options window.

1. Setting Maximum Bars in Chart

- In the Charts tab, set the Max Bars in Chart to Unlimited

2. Allow DLL Imports

- In the Expert Advisors tab, check the box labeled Allow DLL imports.

Once you've made these changes, click OK to save the settings.

Downloading Historical Data Through Running EA in Strategy Tester

Forex Backtrack relies on historical data for accurate backtesting. Follow these steps to download data before using Forex Backtrack:

1. Open the Strategy Tester

In MetaTrader 5, navigate to the View menu and select Strategy Tester, or simply press Ctrl + R on your keyboard. This will open the Strategy Tester panel at the bottom of your MT5 platform.

2. Select Expert Advisor (EA) and Configure Parameters

- Choose Forex Backtrack EA from the Expert dropdown list.

- Select the currency pair in the Symbol dropdown list.

- Set the duration you want to download data for by choosing it in the Date options.

- In the Modelling section, select Every tick as the testing mode.

- Set Optimization to Disabled options.

- Ensure Visual mode is unchecked.

Click the Start button in the Strategy Tester. This will take a while depending on the selected duration. Wait until a confirmation message appears.

1. Running Forex Backtrack with MetaTrader 5 (MT5)

Forex Backtrack integrates seamlessly with MT5, allowing traders to simulate real market conditions. Drag and drop Forex Backtrack EA on live Chart.

2. Choosing and Loading Historical Data

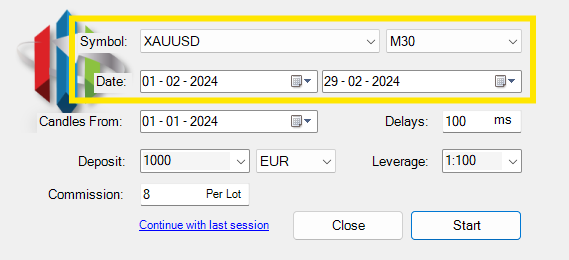

Select your desired symbol, timeframes and duration to load historical data.

Forex Backtrack supports multiple symbols and timeframe, allowing you to test strategies under various market conditions.

3. Setting Account Currency, Leverage, and Other Parameters

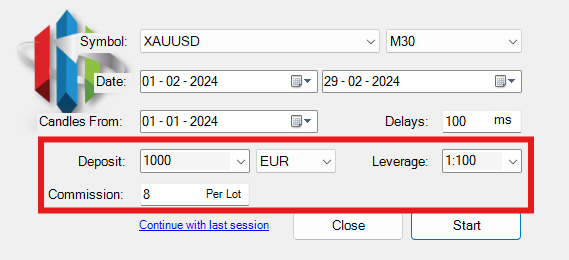

Before starting your simulation, configure your account settings such as Deposit currency, leverage, and initial balance to mirror your live trading environment.

Click the Start button or chooseContinue with last session to begin simulation.

4. Placing and Managing Trades

Open market orders, place pending orders, and manage trades with ease. Set Take Profit (TP) and Stop Loss (SL) levels to see how your strategy performs in different scenarios.

5. Using Timeframes and Indicators

Forex Backtrack allows you to analyze strategies across multiple timeframes using a variety of technical indicators like Moving Averages, Bollinger Bands, and more.

6. Tracking Economic News and Alerts

Stay informed with integrated economic calendars and news alerts. See how major events impact your backtested strategies.

7. Analyzing Performance with Detailed Reports

Forex Backtrack generates detailed performance reports to help you evaluate your strategy's profitability, risk, and success rate. Make adjustments based on these insights.

8. Saving and Loading Simulation Sessions

Save your simulation progress at any point and reload sessions later to continue your testing. This feature is perfect for ongoing analysis and long-term strategy development.

Watch the How-To Video

For a step-by-step video guide, watch our tutorial and get a visual walkthrough of using Forex Backtrack effectively.

Pro Tips for Optimal Results

- Test with Different Timeframes: Always test your strategies on multiple timeframes to ensure robustness.

- Use Multiple Indicators: Combine indicators like RSI and MACD to get more insights into market trends.

- Review Performance Reports: Pay close attention to the performance report to identify weaknesses in your strategy.

Start Backtesting with Forex Backtrack Today!

Now that you know how to use Forex Backtrack, download the simulator and begin refining your trading strategies.

Download Now